Why are CPG industry short-pays so challenging?

The CPG industry is well-known for having challenges with short-pays and deductions. Let’s start with some definitions:

Open Invoice: This is your invoice to a customer that is awaiting payment. The invoiced amount minus payments is the net amount due.

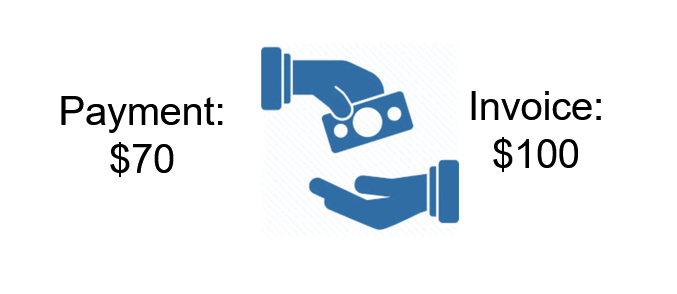

Short-pay: This is the amount that was deducted from your amount due. The amounts deducted PLUS the payment often equal the amount due on your open invoice or invoices. In the picture above, a payment of $70 PLUS a $30 deduction EQUALS the amount due, $100.

Cash Application: This is the business process of matching the check (or ACH) received from the customer to one or more open invoices. This is done in your ERP by your accounts receivable (A/R) team.

What makes the CPG short-pays so challenging?

- Sheer volume of short-pays: Most consumer goods companies ship product frequently, and to many different distribution centers (DCs). This results in a lot of invoices. On the claim side, retail promotions are also frequent, both on the promotional calendar and in the number of items being promoted. All these promotions, along with damages, fines, etc., can result in hundreds, even thousands of short-pays every month!

- Complexity:

- Short-pays taken against un-related invoices: Most industries process and apply short-pays and credits to their open invoices. These credits are typically related to the products and services on the invoice, such as returns or damages related to the products on that specific invoice. CPG is different. In CG, the short-pays typically have NO connection to the invoice. Why? Retailers don’t wait for remittance from the manufacturer for damages, promotions, and other manufacturer charge backs (MCBs). They deduct amounts due from invoices totally unrelated to the claim. Example: Deduct $30 for Promotion A event in January on a March invoice for Product B.

- “Co-mingling” of different types of short-pays: One practice is to gather up all the claims and submit them as one big summarized claim amount. The short-pay isn’t just damages or promotions or fees. The short-pay is a summary that includes all types of claims in different amounts, for different locations, divisions, etc. To process this type of claim you have to ‘debundle’ the short-pay and understand the individual parts before you can resolve it.

- Deduction taken by a distributor on behalf of another customer. Sometimes the short-pay isn’t related to the customer taking the short-pay. A example is UNFI deducting on behalf of its customer, Whole Foods. The manufacturer doesn’t ship to Whole Foods, but offers a promotional allowance to Whole Foods. UNFI short-pays on behalf of Whole Foods. Dot, the redistributor is another example of a distributor deducting for amounts due for the manufacturer’s indirect customers.

- Validation complexity: Every type of claim has a different validation methodology. Scan downs can be validated using IRI, Nielsen and/or POS scan data. Purchase allowances to direct customers such as off-invoice or net-bill need shipment data. Performance allowances, also known as bill-backs, may need to confirm in-store merchandising execution such as displays, shelf signage, etc. Deviated pricing needs the distributor data matched to the contracted price with the operator for validation. These are just a few examples.

- One short-pay taken across many invoices: Imagine you’ve just received a payment for 100 invoices, and included with this partial payment is a short-pay that is not identified or linked to any of these 100 invoices. In your ERP, you must now figure out how to partially apply both the cash payment and the short-pay to these 100 invoices.

- Many deductions taken at once, but not invoice specific: Lets picture we get a remittance that shows us 100 of our invoices that are paid in full. On that remittance we also see 25 deductions. Our check, plus the sum of these 25 deductions equals the amount due on our invoices. In our ERP, we must now figure out how to apply the check and these 25 deductions to the 100 open invoices. (Yes, this is really happens in CG!)

- Cash-App is only the beginning: Recognizing the short-pay during the cash-app process doesn’t mean you’ve resolved the short-pay. Resolving the open balance of each deduction is a workflow onto itself. Each individual charge-back claim requires research to determine what it is and if it is valid. Shortpays are typically resolved in one of these ways:

- Promotional: Match some or all of the shortpay to one or more promotional events. e., $1,000 ad fee deducted in March must be matched and resolved to the promotion back in January.

- Non-Promotional: Using credit memos, resolve some of the short-pay by expensing it to one or more chart-of-accounts. e., damages.

- Invalid, Re-Invoice: If the short-pay isn’t valid, you may choose to dispute the claim and request repayment. i.e., A $1,000 ad fee was deducted twice for the same ad.

- Detailed reporting expectations: The ability of computers to process massive amounts of data has raised everyone’s expectations for reporting. We now expect to see summarized deduction data that we can ‘slice and dice’ any way we want, and drill all the way down to the item, customer, claim, invoice, reason code, transaction date, promotional event, etc. However, we can’t report on data if it’s not created and stored at this granular level.

- Short-staffed: Many account teams are under staffed. Processing short-pays with all the detail we need for reporting can require tedious data entry, and manipulation of Excel spreadsheets.

- No back-up or details: Imagine you now have to process a short-pay across a lot of open invoices, but your customer didn’t give you any details about the short-pay. You have to start the deduction workflow process, and request back-up detail from retailer to help you research and resolve the open deduction.

CG retailers improve their cash flow by short-paying the money they are owed. They don't wait weeks or months for a manufacturer to process their claims. With retailers under ever-increasing competitive pressure, we should not expect the phenomenon of complex short-pays to go away anytime soon.

Leading CG manufacturers leverage their ERP and a TPM solution to process and manage complex short-pays.

Alex Ring, President

CG Squared, Inc. .